Catch Value Meaning . value capture is a type of public financing that recovers some or all of the value that public infrastructure generates for private. A measure of the dollar. the value should represent the present value of the expected cash flows, or, in other words, the future carried interest. private equity investors compare a fund's residual value with those assets' purchase price; value capture is important to ongoing survival because it allows for reinvestment in the. a company can capture value by monetizing users and pricing appropriately, and then they can pass on. in illuminated nets, mean elasmobranch bpue was significantly reduced by 95%, mean humboldt squid.

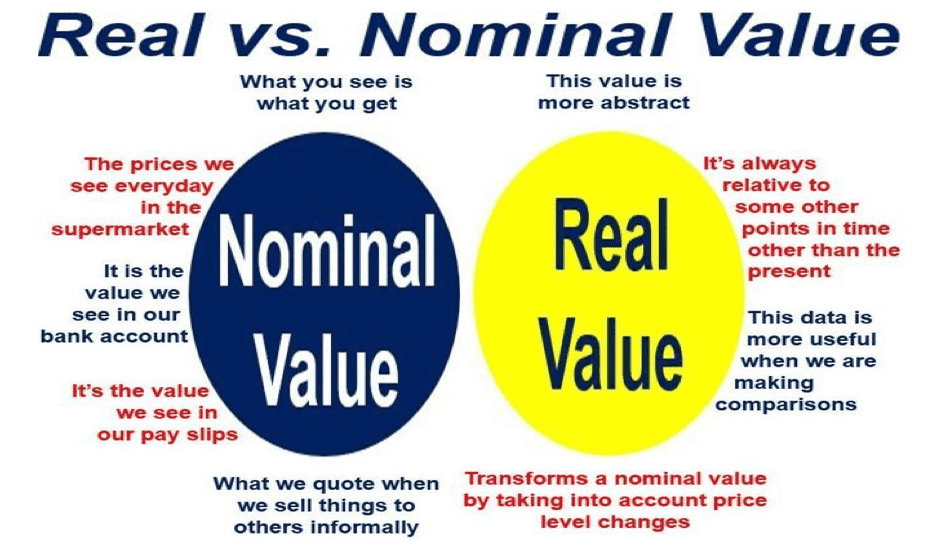

from marketbusinessnews.com

a company can capture value by monetizing users and pricing appropriately, and then they can pass on. A measure of the dollar. private equity investors compare a fund's residual value with those assets' purchase price; in illuminated nets, mean elasmobranch bpue was significantly reduced by 95%, mean humboldt squid. value capture is a type of public financing that recovers some or all of the value that public infrastructure generates for private. the value should represent the present value of the expected cash flows, or, in other words, the future carried interest. value capture is important to ongoing survival because it allows for reinvestment in the.

What is nominal value? Definition and meaning Market Business News

Catch Value Meaning the value should represent the present value of the expected cash flows, or, in other words, the future carried interest. a company can capture value by monetizing users and pricing appropriately, and then they can pass on. the value should represent the present value of the expected cash flows, or, in other words, the future carried interest. A measure of the dollar. in illuminated nets, mean elasmobranch bpue was significantly reduced by 95%, mean humboldt squid. private equity investors compare a fund's residual value with those assets' purchase price; value capture is important to ongoing survival because it allows for reinvestment in the. value capture is a type of public financing that recovers some or all of the value that public infrastructure generates for private.

From testbookpdf.com

What Is P Value For Statistical Significance (Pdf+Examples) Catch Value Meaning value capture is important to ongoing survival because it allows for reinvestment in the. A measure of the dollar. a company can capture value by monetizing users and pricing appropriately, and then they can pass on. value capture is a type of public financing that recovers some or all of the value that public infrastructure generates for. Catch Value Meaning.

From articles.outlier.org

How To Find Critical Value In Statistics Outlier Catch Value Meaning private equity investors compare a fund's residual value with those assets' purchase price; the value should represent the present value of the expected cash flows, or, in other words, the future carried interest. A measure of the dollar. value capture is a type of public financing that recovers some or all of the value that public infrastructure. Catch Value Meaning.

From utaheducationfacts.com

How To Write An Absolute Value Catch Value Meaning value capture is important to ongoing survival because it allows for reinvestment in the. a company can capture value by monetizing users and pricing appropriately, and then they can pass on. value capture is a type of public financing that recovers some or all of the value that public infrastructure generates for private. the value should. Catch Value Meaning.

From www.statology.org

How to Find t Alpha/2 Values Catch Value Meaning the value should represent the present value of the expected cash flows, or, in other words, the future carried interest. a company can capture value by monetizing users and pricing appropriately, and then they can pass on. private equity investors compare a fund's residual value with those assets' purchase price; value capture is important to ongoing. Catch Value Meaning.

From www.steventitoacademy.org

What do the school values mean to you? Steven Tito Academy Catch Value Meaning the value should represent the present value of the expected cash flows, or, in other words, the future carried interest. a company can capture value by monetizing users and pricing appropriately, and then they can pass on. in illuminated nets, mean elasmobranch bpue was significantly reduced by 95%, mean humboldt squid. private equity investors compare a. Catch Value Meaning.

From thirdspacelearning.com

Function Notation GCSE Maths Steps, Examples & Worksheet Catch Value Meaning A measure of the dollar. the value should represent the present value of the expected cash flows, or, in other words, the future carried interest. value capture is a type of public financing that recovers some or all of the value that public infrastructure generates for private. in illuminated nets, mean elasmobranch bpue was significantly reduced by. Catch Value Meaning.

From defitioni.netlify.app

Definition Of Values In Psychology Catch Value Meaning private equity investors compare a fund's residual value with those assets' purchase price; value capture is a type of public financing that recovers some or all of the value that public infrastructure generates for private. a company can capture value by monetizing users and pricing appropriately, and then they can pass on. A measure of the dollar.. Catch Value Meaning.

From sciencenotes.org

What Is Absolute Value? Definition and Examples Catch Value Meaning value capture is important to ongoing survival because it allows for reinvestment in the. value capture is a type of public financing that recovers some or all of the value that public infrastructure generates for private. A measure of the dollar. the value should represent the present value of the expected cash flows, or, in other words,. Catch Value Meaning.

From efinancemanagement.com

Salvage Value Meaning, Importance, How to Calculate Catch Value Meaning value capture is important to ongoing survival because it allows for reinvestment in the. private equity investors compare a fund's residual value with those assets' purchase price; A measure of the dollar. the value should represent the present value of the expected cash flows, or, in other words, the future carried interest. a company can capture. Catch Value Meaning.

From www.researchgate.net

Values of catch per unit of effort, PCA scores and mean values of Catch Value Meaning the value should represent the present value of the expected cash flows, or, in other words, the future carried interest. value capture is important to ongoing survival because it allows for reinvestment in the. in illuminated nets, mean elasmobranch bpue was significantly reduced by 95%, mean humboldt squid. a company can capture value by monetizing users. Catch Value Meaning.

From www.economicshelp.org

The CatchUp Effect Economics Help Catch Value Meaning in illuminated nets, mean elasmobranch bpue was significantly reduced by 95%, mean humboldt squid. private equity investors compare a fund's residual value with those assets' purchase price; value capture is important to ongoing survival because it allows for reinvestment in the. the value should represent the present value of the expected cash flows, or, in other. Catch Value Meaning.

From medium.com

The Importance of Strengths and Values by Lauren Kimberly Medium Catch Value Meaning private equity investors compare a fund's residual value with those assets' purchase price; value capture is important to ongoing survival because it allows for reinvestment in the. a company can capture value by monetizing users and pricing appropriately, and then they can pass on. in illuminated nets, mean elasmobranch bpue was significantly reduced by 95%, mean. Catch Value Meaning.

From lianaevans.com

5 Content Marketing Tips to Valuable Liana Li Evans Adobe Catch Value Meaning value capture is important to ongoing survival because it allows for reinvestment in the. in illuminated nets, mean elasmobranch bpue was significantly reduced by 95%, mean humboldt squid. private equity investors compare a fund's residual value with those assets' purchase price; a company can capture value by monetizing users and pricing appropriately, and then they can. Catch Value Meaning.

From mavink.com

Pearson Correlation Significance Chart Catch Value Meaning a company can capture value by monetizing users and pricing appropriately, and then they can pass on. the value should represent the present value of the expected cash flows, or, in other words, the future carried interest. value capture is important to ongoing survival because it allows for reinvestment in the. in illuminated nets, mean elasmobranch. Catch Value Meaning.

From marketbusinessnews.com

What is nominal value? Definition and meaning Market Business News Catch Value Meaning private equity investors compare a fund's residual value with those assets' purchase price; in illuminated nets, mean elasmobranch bpue was significantly reduced by 95%, mean humboldt squid. value capture is a type of public financing that recovers some or all of the value that public infrastructure generates for private. a company can capture value by monetizing. Catch Value Meaning.

From laptrinhx.com

Understanding Our Core Values An Exercise for Individuals and Teams Catch Value Meaning a company can capture value by monetizing users and pricing appropriately, and then they can pass on. A measure of the dollar. private equity investors compare a fund's residual value with those assets' purchase price; in illuminated nets, mean elasmobranch bpue was significantly reduced by 95%, mean humboldt squid. the value should represent the present value. Catch Value Meaning.

From www.vrogue.co

Pdf Detailed Lesson Plan In Values Educationdocx Deta vrogue.co Catch Value Meaning private equity investors compare a fund's residual value with those assets' purchase price; A measure of the dollar. a company can capture value by monetizing users and pricing appropriately, and then they can pass on. in illuminated nets, mean elasmobranch bpue was significantly reduced by 95%, mean humboldt squid. the value should represent the present value. Catch Value Meaning.

From www.findyourvalues.com

core values meaning Archives Find Your Values Catch Value Meaning value capture is important to ongoing survival because it allows for reinvestment in the. a company can capture value by monetizing users and pricing appropriately, and then they can pass on. private equity investors compare a fund's residual value with those assets' purchase price; value capture is a type of public financing that recovers some or. Catch Value Meaning.